28+ write off mortgage interest

Web The home mortgage interest deduction allows you to reduce your taxable income from the previous year by the total interest paid on your mortgage debt up to. In this case as a couple.

Mortgage Interest Deduction Rules Limits For 2023

Ad Developed by Lawyers.

. See what makes us different. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Web The benefits of claiming your mortgage interest include.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million. Web The date your home equity loan was signed could influence the deduction youre able to take.

Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction. You may still be able to. Single or married filing separately 12550.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. We dont make judgments or prescribe specific policies. Other closing costs are not.

Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. 1 reducing income and increasing deductions 2 deducting the interest you paid on a home equity loan 3. LawDepot Has You Covered with a Wide Variety of Legal Documents.

Web Mortgage interest. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. You filed an IRS form 1040 and itemized your deductions.

15 2017 you can. Create Your Satisfaction of Mortgage. Web Typically the only closing costs that are tax deductible are payments toward mortgage interest buying points or property taxes.

Web The write-off is limited to interest on up to 750000 375000 for married-filing-separately taxpayers of mortgage debt incurred after Dec. Web To qualify for a home mortgage interest tax deduction homeowners must meet these two requirements. If you took out a home equity loan after Dec.

Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and. Married filing jointly or qualifying widow. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025.

Web For 2021 tax returns the government has raised the standard deduction to. 2000 Your total itemized deductions come out to 14500. Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000.

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

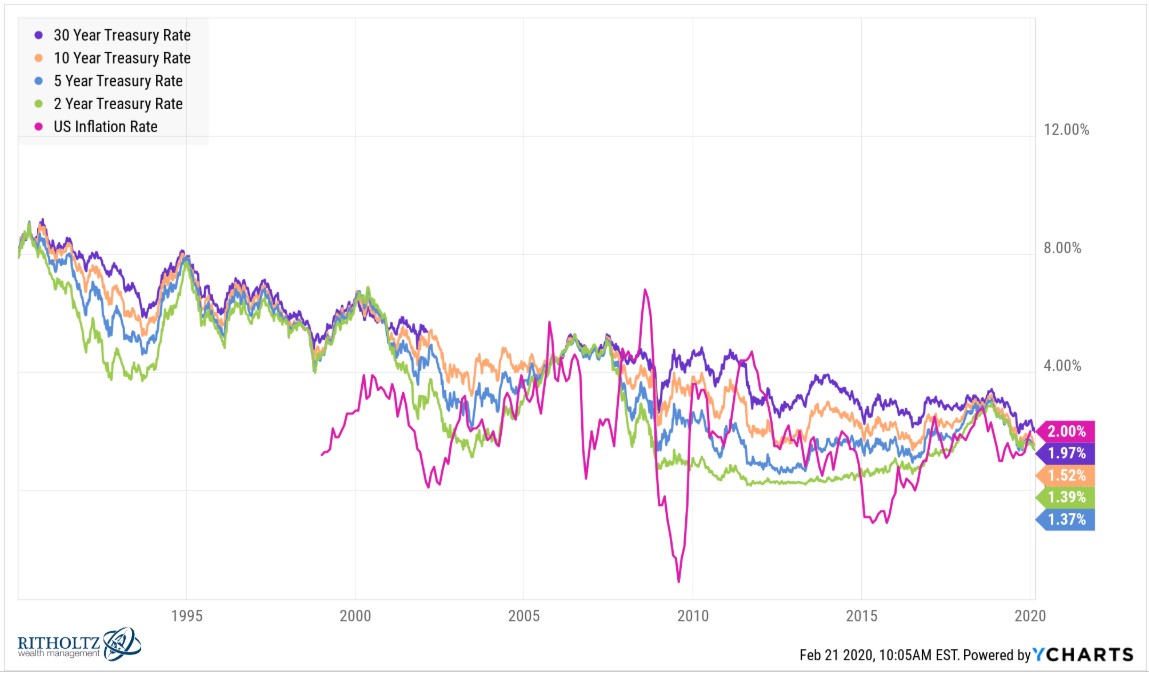

Should You Pay Off Your Mortgage Early With Rates So Low

Biotech Layoffs Novartis Bluebird And 28 Other Companies Add To The Growing List Of Xbi Biotech Companies Laying Off In 2022 R Biotechplays

Chalet Martine Chalet Martine

Mortgage Interest Deduction Bankrate

Enantioselective Photochemical Reactions Enabled By Triplet Energy Transfer Chemical Reviews

4ptdun4cmpbstm

56 Nassau Road Roosevelt Ny 11575 Mls 3372015 Howard Hanna

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

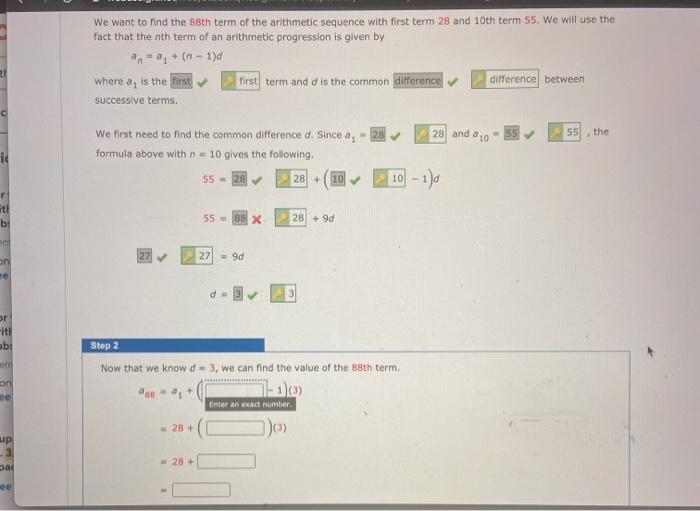

Solved If You Lend 5900 To A Friend For 15 Months At 4 Chegg Com

Take The Full Deduction On Mortgage Interest Ahead Of The New Tax Law Accountingweb

Mortgage Interest Tax Deduction 2022 What If You Forget

Mortgage Interest Deductions Tax Break Abn Amro

Launch Obd2 Scanner Crp909e Full System Car Scan Tool 28 Reset Service Automotive Scanner Injector Coding Key Immo Abs Bleeding Tpms Auto Vin 2years Free Update Upgrade Version

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Home Mortgage Loan Interest Payments Points Deduction

Chalet Martine Chalet Martine